AI in Financial Services: Opportunities and Challenges

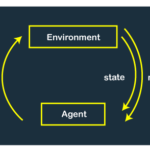

Artificial Intelligence (AI) has made significant inroads into the financial services industry, transforming how organizations operate, make decisions, and engage with customers. With its ability to analyze vast amounts of data, detect patterns, and automate processes, AI has opened up new opportunities for improved efficiency, personalized experiences, and better risk management. In this blog, we will explore the opportunities AI presents in financial services, as well as the challenges that come with its implementation.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants are revolutionizing customer interactions in the financial services sector. These intelligent systems can handle customer inquiries, provide personalized recommendations, and assist with transactions. By leveraging natural language processing and machine learning algorithms, AI enables organizations to deliver faster, more efficient, and personalized customer experiences, leading to increased satisfaction and loyalty.

Fraud Detection and Risk Management

AI plays a crucial role in detecting and preventing fraudulent activities in financial transactions. Machine learning algorithms can analyze historical data and identify patterns of fraudulent behavior, enabling real-time monitoring and early detection of suspicious activities. AI-powered risk management systems can assess creditworthiness, detect anomalies in trading patterns, and improve compliance with regulatory requirements. These applications enhance security, protect customer interests, and mitigate financial risks.

Investment and Trading

AI algorithms are increasingly being used in investment and trading strategies. Machine learning models can analyze large datasets, identify market trends, and make data-driven investment decisions. AI-powered trading systems can execute trades with speed and precision, leveraging algorithms to optimize trading strategies. These applications improve portfolio management, enhance trading efficiency, and enable organizations to capitalize on market opportunities.

Credit Scoring and Underwriting

AI has the potential to revolutionize credit scoring and underwriting processes. By leveraging machine learning algorithms, organizations can analyze diverse data sources, such as credit history, social media profiles, and transactional data, to assess creditworthiness. AI-powered underwriting systems can automate loan approvals, reduce processing times, and make more accurate risk assessments. This streamlines the lending process and improves access to credit for individuals and businesses.

Robo-Advisors and Wealth Management

AI-powered robo-advisors are disrupting the wealth management industry. These digital platforms utilize AI algorithms to provide personalized investment advice, asset allocation strategies, and portfolio management services. Robo-advisors offer cost-effective and accessible investment solutions, democratizing wealth management and making it available to a broader range of individuals. However, challenges such as regulatory compliance and the need for human oversight remain critical considerations.

Data Security and Privacy

As financial institutions increasingly rely on AI, ensuring data security and privacy becomes crucial. AI systems require access to sensitive customer information to make accurate predictions and deliver personalized experiences. Financial organizations must invest in robust data security measures, encryption protocols, and privacy frameworks to safeguard customer data. Ethical considerations around data usage and transparency are essential to build trust and maintain regulatory compliance.

Ethical and Responsible AI Usage

The adoption of AI in financial services raises ethical considerations. Bias in algorithms, algorithmic transparency, and accountability are key challenges that need to be addressed. Ensuring fairness and avoiding discrimination in credit decisions, as well as preventing algorithmic biases in AI-driven investments, are critical areas of focus. Financial institutions need to establish governance frameworks and standards to ensure responsible AI usage and maintain public trust.